Last month, EY (formerly Ernst & Young) released the ninth edition of the Africa Attractiveness report, which describes trends and opportunities in Africa’s economic growth and in foreign direct investment (FDI) to the continent.

The report finds that, in 2018, FDI to Africa remained generally steady. While FDI flows were small by global standards, the ratio of FDI to gross domestic product (GDP) was high, signaling the importance of FDI to the continent’s economic growth.

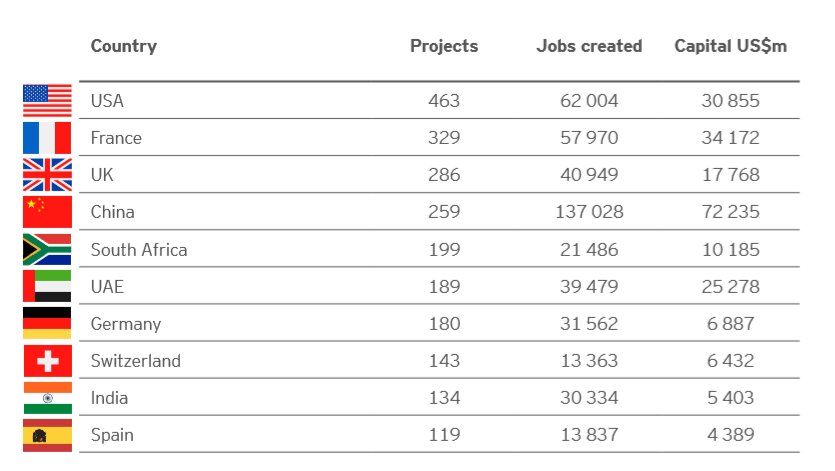

As Figure 1 shows, the largest investors by number of projects in Africa were the United States, France, and the United Kingdom, respectively. Notably, China was the largest investor in terms of total capital, investing more than twice the dollar amount of France or the U.S. The report states that FDI flows from traditional investors are partially driven by strong historical relationships: France, for instance, is a key investor in francophone Africa. Emerging partners, including China, the United Arab Emirates (UAE), and India, are playing an increasingly important role in Africa, accounting for 34 percent of total projects and over 50 percent of jobs created and capital investments. Additionally, intra-African investment continued to grow in 2018: South Africa remained the most extensive investor in other African countries, and Kenya and Nigeria contributed significant FDI to East and West Africa respectively. Egypt and Morocco are major investors in North Africa.

Figure 1: FDI 2014-2018 by source

Figure 2 lists the top 15 recipients of FDI in Africa, calculated using a weighted average based on number of projects, jobs created, and value of investments. The results indicate that FDI largely follows economic growth, policy reform, economic diversification, and GDP size. For example, the report states that South Africa’s high level of FDI is, at least, partially due to its diverse and relatively large economy, which provides more investment opportunities. Conversely, Rwanda is evidence that economic reform and business-friendly policies can attract investor interest, even in small economies.

Figure 2: Largest recipients of FDI in Africa, 2018

In addition to describing the major sources and destinations of FDI, the report additionally analyzes FDI by sector. While extractives attracted a large portion of inbound capital in 2018 (36 percent), the majority of projects and jobs created were actually in the services and industry sectors. Figure 3 shows that the telecoms, media, and technology (TMT) and consumer products and retail (CPR) sectors gained increased prominence in 2018. The report states that FDI in the consumer segment has been driven by the demands of Africa’s rapidly urbanizing population with rising income levels, while investment in TMT has been driven by a rise in investment for technology and the increasing trend of global technology companies establishing a presence in Africa.

Figure 3: FDI projects by sector, 2018

The report concludes by emphasizing the importance of both economic growth and reform in attracting FDI. It recommends that African governments take steps to diversify their economies in order to reduce susceptibility to macroeconomic shocks and provide a better environment for investors. The report also states that trade may become a key enabler of future growth, as the African Continental Free Trade Agreement (AfCFTA) should facilitate quicker, more efficient, and cheaper trade as well as stimulate economic activity.

Dhruv Gandhi, Payce Madden

December 18, 2019

Emerging Markets & Developing Economies Figures of the week: Trends and determinants in Chinese FDI in Africa

Emerging Markets & Developing Economies Figures of the week: EY’s Attractiveness Program Africa — Connectivity Redefined